1. The lease payments (as described in paragraph 842-10-30-5) not yet received by the lessor 2. The amount the lessor expects to derive from the underlying asset following the end of the lease term that is guaranteed by the lessee or any other third party unrelated to the lessor.

Prepaid Rent Accounting Entry | Double Entry Bookkeeping

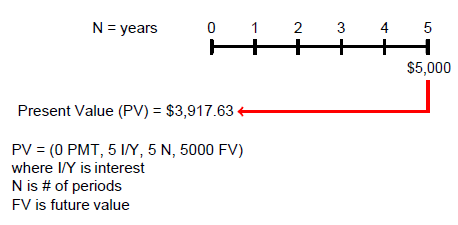

Add the future cash flows due to the lessor. Add the period the cash flows are in relation to in this case 0 to 9. Decide on a discount rate to present value the future payments in this example 6%. Each individual period is present valued and the total sum of those figures equals $9,585.98.

Source Image: scribd.com

Download Image

Contents Determining the lease liability 1 1 At a glance 2 1.1 Key facts 2 1.2 Key impacts 3 2 Lease payments 4 2.1 What does a lessee include in its lease liability? 4 2.1.1 Categories of lease payment 5 2.1.2 Residual value guarantees 5 2.1.3 Renewal, termination and purchase options 7 2.2 Lessor considerations 10

Source Image: ecampusontario.pressbooks.pub

Download Image

Lease Accounting Insights Lease term = five years, commencing January 1, 2010, with no renewal options. Five annual payments due in arrears (at December 31) of CU2,474 (total payments = CU12,370). Payments are made as scheduled (not delinquent). Present value (PV) of lease payments at the beginning of the lease = CU9,378. Interest component of lease payments = CU12,370

Source Image: eslbuzz.com

Download Image

The Lease Receivable Amount Includes The Present Value Of

Lease term = five years, commencing January 1, 2010, with no renewal options. Five annual payments due in arrears (at December 31) of CU2,474 (total payments = CU12,370). Payments are made as scheduled (not delinquent). Present value (PV) of lease payments at the beginning of the lease = CU9,378. Interest component of lease payments = CU12,370 At the commencement date, a lessee will record a lease liability equal to the present value of the remaining lease payments. For any individual lease contract, the liability should be discounted using the rate implicit in the lease if readily determinable. If that rate is not readily determinable, the borrowing rate of the lessee may be

Accounting Terms: A Simple Guide to the World of Money – ESLBUZZ

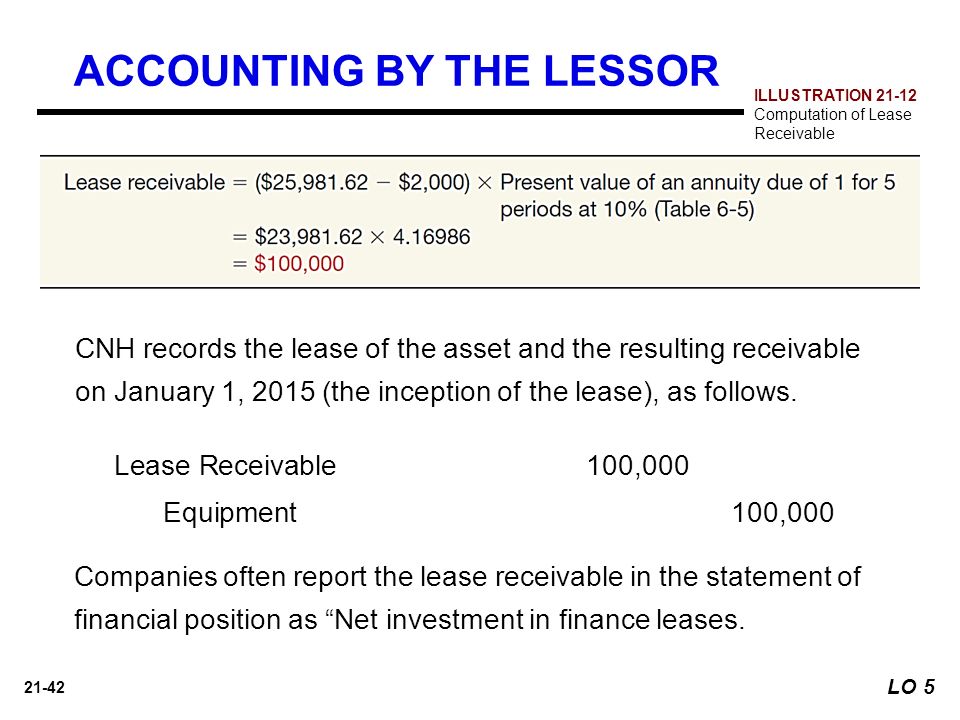

The lease receivable amount includes the present value of A. rental payments plus the present value of guaranteed and unguaranteed residual values. … The lease payments were determined to have a present value of A. $ 1,16,604. B. $ 833,972. C. $ 1,400,000. D. $ 200,000. B. $ 833,972. About us. About Quizlet; How Quizlet works; Careers Chapter 17 – Intermediate Financial Accounting 2

Source Image: ecampusontario.pressbooks.pub

Download Image

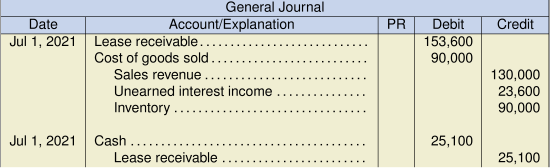

21 Chapter Accounting for Leases Intermediate Accounting 12th Edition – ppt video online download The lease receivable amount includes the present value of A. rental payments plus the present value of guaranteed and unguaranteed residual values. … The lease payments were determined to have a present value of A. $ 1,16,604. B. $ 833,972. C. $ 1,400,000. D. $ 200,000. B. $ 833,972. About us. About Quizlet; How Quizlet works; Careers

Source Image: slideplayer.com

Download Image

Prepaid Rent Accounting Entry | Double Entry Bookkeeping 1. The lease payments (as described in paragraph 842-10-30-5) not yet received by the lessor 2. The amount the lessor expects to derive from the underlying asset following the end of the lease term that is guaranteed by the lessee or any other third party unrelated to the lessor.

Source Image: double-entry-bookkeeping.com

Download Image

Lease Accounting Insights Contents Determining the lease liability 1 1 At a glance 2 1.1 Key facts 2 1.2 Key impacts 3 2 Lease payments 4 2.1 What does a lessee include in its lease liability? 4 2.1.1 Categories of lease payment 5 2.1.2 Residual value guarantees 5 2.1.3 Renewal, termination and purchase options 7 2.2 Lessor considerations 10

Source Image: cradleaccounting.com

Download Image

6.3 Receivables – Intermediate Financial Accounting 1 Aug 31, 2023The present value of $843,048 is lower than the fair value amount of $864,000. The leased asset and the associated lease obligation will be the amount of the present value of the lessee’s minimum lease payments of $843,048. For the lessee, the analysis reveals that this lease meets two of the criteria for capitalization.

Source Image: ecampusontario.pressbooks.pub

Download Image

Intermediate Accounting II Chapter ppt download Lease term = five years, commencing January 1, 2010, with no renewal options. Five annual payments due in arrears (at December 31) of CU2,474 (total payments = CU12,370). Payments are made as scheduled (not delinquent). Present value (PV) of lease payments at the beginning of the lease = CU9,378. Interest component of lease payments = CU12,370

Source Image: slideplayer.com

Download Image

PREVIEW OF CHAPTER 21 Intermediate Accounting IFRS 2nd Edition – ppt download At the commencement date, a lessee will record a lease liability equal to the present value of the remaining lease payments. For any individual lease contract, the liability should be discounted using the rate implicit in the lease if readily determinable. If that rate is not readily determinable, the borrowing rate of the lessee may be

Source Image: slideplayer.com

Download Image

21 Chapter Accounting for Leases Intermediate Accounting 12th Edition – ppt video online download

PREVIEW OF CHAPTER 21 Intermediate Accounting IFRS 2nd Edition – ppt download Add the future cash flows due to the lessor. Add the period the cash flows are in relation to in this case 0 to 9. Decide on a discount rate to present value the future payments in this example 6%. Each individual period is present valued and the total sum of those figures equals $9,585.98.

Lease Accounting Insights Intermediate Accounting II Chapter ppt download Aug 31, 2023The present value of $843,048 is lower than the fair value amount of $864,000. The leased asset and the associated lease obligation will be the amount of the present value of the lessee’s minimum lease payments of $843,048. For the lessee, the analysis reveals that this lease meets two of the criteria for capitalization.